BY MIKE TUA

THOUSANDS of women in the rural areas throughout Solomon Islands are members of Savings Groups that provide essential services to help manage their daily lives.

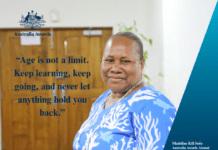

Earlier this week, Solomon Women’s News managed to interview Helen Tau, Advisor for Varitokai Women’s Saving Club in Gizo, Western Province.

Tau and her Saving Group are in the capital, Honiara to attend the 16th Anniversary of West ‘Are’Are Rokotanikeni Saving Club Association – the leading promoter of community-based, saving-led microfinance in the country.

The 39 year old joined Varitokai Women’s Saving Club – subsidiary body of the Gizo Environment Livelihood Conservation Association (GELCA) since its establishment in 2013.

“Our Savings Groups Association has played a major role in financial inclusion, social protection, and economic empowerment of women in our rural communities to overcome the barriers that prevent them from earning and saving incomes generated from small business activities,” she said.

The mother of five said it is very important for women to join a saving scheme because nowadays, a saving club has made big positive differences a big thing in the lives of ordinary people especially for us joining and becoming a saving club member.

“Looking at the survival of people within a family and community we depend on money but when we don’t know how to save money we will always experience all sorts of problems in our homes.

“For example – Families have big demand to send their kids to school, need development at home and property of children which is all about money but when we don’t know about saving it seems that our lives will be just the same.

“There are no formal banking services available in rural areas of Solomon Islands and there are high fees for simple banking transactions. It is often hard for women to reach banks because they are busy caring for children and elders, cooking, tending the vegetable garden and selling excess produce. They may also need the permission of their male family members to travel.

“There are no formal banking services available in rural areas of Solomon Islands and there are high fees for simple banking transactions. It is often hard for women to reach banks because they are busy caring for children and elders, cooking, tending the vegetable garden and selling excess produce. They may also need the permission of their male family members to travel,” she said.

According to Helen Tau, the saving club has opened and broadened her mind about the importance of life and how to survive and look after money to support her family.

“Being a member of a rural saving club means I have a positive future ahead of me, and also know that the saving club would help me find new opportunities in life – it enables me to obtain new knowledge and skills through financial literacy trainings,” she said.

Women’s savings clubs are one way to provide women with a safe place to save money.

“I have decided to join a saving club because it has a very good set up body (well established body), where there is transparency and common understanding well established in it,” she said.

“And also because it deals with women only and that is why I am really interested to join it but if men are allowed to join a saving club – 100%, I will not join because men always look down on us women, and sometimes they never respect the views women and on the cultural side they always think man always make good decisions so I will not be interested to join a saving club if men are allowed to join a saving club.”

Literacy and numeracy levels in rural Solomon Islands are very low so understanding finances, banking and saving is also a problem, particularly for women who have lower literacy and numeracy rates than men.

Gender inequality also reduces women’s ability to manage their finances. Men are often seen as the head of the household, so they are responsible for making decisions about finances. This can mean that some men feel they have the right to take and spend money earned by their wives or other female family members.

If a woman wants to save money she might resort to hiding it in or around the house. This can put them in danger as their husband or other male family members may use violence to coerce them into revealing where the money is hidden.

Ms Tau plays a major responsibility as GELCA’s Women’s Saving Club Association – Advisory Committee Representative of Varitokae Women’s Saving Club.

She said overall, as an advisor of our saving club, we also experience some challenges.

“I have experienced challenges to among women members of our saving club especially to ensure they have a positive understanding to know more about the saving scheme and importance of saving money.”

She said one of my major personal challenges is when there is lack of support from my family members and close relatives.

“For example – I operated few small businesses like laundry, house for rental and bakery and my husband manages and operates our family small canteen business.

“My extended family doesn’t understand me completely and they always ask for kaon because they thought I have a small business background. I never refuse them and it has become my major challenge,” she said.

Mrs Tau is a former employee of Save the Children Organization. She retired in 2012 and has now been an active member of Varitokai Women’s Saving Club in Gizo, Western province.

She said: “One thing I have learned as a saving club member and has served me well over the years is self-discipline.

“One big thing I learn from the saving club is the ability to save money and when I worked with Save the Children Organization, I earned $1000 plus in my fortnight salary, but my problem was I never save money and I always have a zero balance after my paydays are over.

“But when I joined the saving club I earn only hundreds but I can save, manage and use my money rightfully, the saving scheme has changed my attitude.

“Nowadays, I am able to discipline myself and I can see the importance of my family needs, but when I haven’t joined the saving club, I have no sense of direction and good planning in my day to day living,” she said.

Mrs. Tau’s greatest influence to join a savings club comes from Dr. Alice Pollard, Founder of Rokotanikeni Savings Club Association in West Are’are.

“Dr. Alice Pollard has taught me the importance of saving and how it changed my mindset and life and how it can excel the financial status of women in their respective communities and to be able to develop and grow to a new height in the men dominated society.

“During my time as an employee of Save the Children I never grow because no one has convinced me to grow financially but through Dr. Pollard, she encouraged women to start saving money now to become somebody successful in the future,” she said.

She encouraged women to join saving clubs so that they cannot be left out in any significant opportunities a saving club can provide them in their society.

“A saving scheme can provide good chances for women to learn more new things they have never learned in their lifetime. For example if you are woman who only knows one thing, she can know more new things through the saving scheme.

“Therefore, I want encourage more women to take a first step by joining a nearest saving club in your community because as you go along you will be able to know the importance of saving and it will broaden your understanding more,” she added.