THE West Are’are Women’s Savings Club group known as the Rokotanikeni Association had recently launched their first ever-financial investment fund in Honiara.

The launching program took place at Mendana Hotel and was witnessed by special guests from the Solomon Islands National Provident Fund (SINPF).

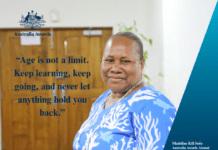

Speaking to Isles Media, Founder of the group Dr Alice Pollard said it is their new product, which is called in Are’are language as ‘Haiamasiha’ and which simply means ‘we care for each other.’

Dr Pollard said the idea of launching the program was based on their experience over the last 10 years when the West Are’are Rokotanikeni Association started its savings program.

“Since we started, we noted that most of the withdrawals made from the savings was mainly for school fees,” she said.

She said from that observation, the objective of creating and developing the Haiamasiha Fund or WARA Cares Fund is a top up thing to the original goal that was to help support the children in terms of their education and other special needs.

Mrs. Pollard added the fund is basically a collective one unlike the savings club, which is an individual based savings.

“The Haiamasiha fund is to provide financial care and support for each other when it comes to individual needs especially in education of our children,” she said.

Mrs Pollard said their aim is to ensure education is accessible to every little boys and girls in west Are’are.

She said the fund will help to assist another member who might save but is unable to meet her demand or requirement especially when it comes to schools fees or other related educational needs.

“Not only Education, but later we will also look at supporting health and care initiatives for our old aged members and leaders in our community.

“In the community level, some of our women have volunteered and they have really sacrificed themselves to take up several duties with the management of our scheme of savings but we have no systems in place so that we could give something to say thank you to them,” she added.

She said they decided to allow the fund to grow for at least two years where they will monitor how much they have, so that it could be opened up for implementation.

Dr Pollard said they are looking forward to create that fund as well as to create an account for the fund so they could be able to administer it.

“In terms of membership fees, members can contribute with any amount depending on their savings but the lowest would be around $10 each per year,” she said.